THE #1 TAX CARE PROVIDER FOR MEDICAL PROFESSIONALS

THE #1 TAX CARE PROVIDER FOR MEDICAL PROFESSIONALS

We understand the unique challenges and opportunities faced by physicians and healthcare professionals.

You dedicate your career to caring for others, but who's taking care of your financial well-being?

As your dedicated tax partner, we provide effective solutions designed to help you achieve long-term tax wellness.

We understand the unique challenges and opportunities faced by physicians and healthcare professionals. You dedicate your career to caring for others, but who's taking care of your financial well-being?

As your dedicated tax partner, we provide effective solutions designed to help you achieve long-term tax wellness.

Why Choose Medicus for Your Tax Planning?

Why Choose Medicus for your Tax Planning?

Comprehensive Services for Healthcare Professionals

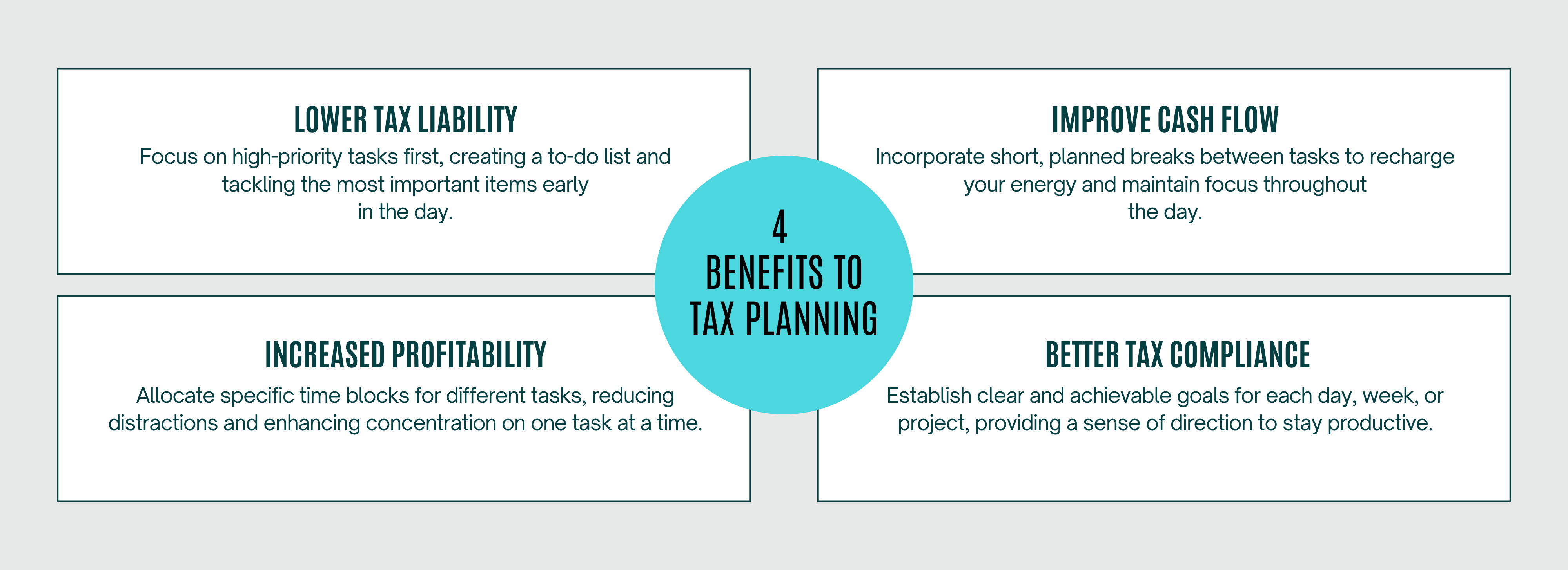

Medicus clients always receive proactive tax planning with a personalized approach.

Compliance is the act of actually filing your individual state and federal income taxes, along with an entity income tax filings.

Our clients depend on our expertise to find and update proactive tax strategies to save thousands of dollars each year.

We love helping our clients take their tax savings and using that savings to build a tax-efficient retirement plan.

As one of our additional services, we can help clients with their accounting practices.

Sometimes clients ask us to take on a larger role in their financial operations.

Here's some other things we have taken care of for clients presently and in the past.

Take Control of Your Taxes

Let's discuss your unique tax goals and demonstrate how our comprehensive services can help you achieve tax security and peace of mind. You may also schedule an appointment on our calendar by clicking here.